wake county nc sales tax rate 2019

The Wake County sales tax rate is. Wake County sales tax.

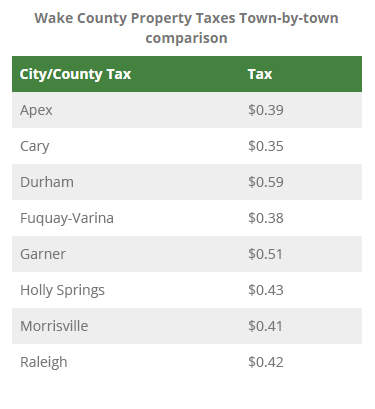

Property Taxes By State Embrace Higher Property Taxes

6 rows The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina.

. County Rates with Effective Dates as of October 1 2018. North Carolina has recent rate changes Fri Jan 01 2021. Wake County in North Carolina has a tax rate of 725 for 2022 this includes the North Carolina Sales Tax Rate of 475 and Local Sales Tax Rates in Wake County totaling 25.

The 725 sales tax rate in Wake Forest consists of 475 North Carolina state sales. This document serves as notice that effective April 1 2017 Wake County by resolution levies an additional 050 local sales and use tax. Sales and Use Tax Rates Effective October 1 2020.

This tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises by any retailer with sales in Wake County that are subject to sales tax imposed by the State under North Carolina General Statute NCGS 105-1644a1. The total sales tax rate in any given location can be broken down into state county city and special district rates. Select the North Carolina city from the list of popular cities below to.

With local taxes the total sales tax rate is between 6750 and 7500. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule. County Rates with Effective Dates as of April 1 2019.

There are a total of 459 local tax jurisdictions. County Rates with Effective Dates as of October 1 2016. A Transit Improvement Area sales tax increase affected rates in.

The minimum combined 2022 sales tax rate for Wake County North Carolina is. County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted By 5-Digit Zip. Listed below by county are the total.

The additional 050 local sales and use tax is for the benefit and purpose of the Research Triangle Regional Public Transportation Authority dba GoTriangle and is to be used only for public transportation systems. North Carolina state sales tax. The state sales tax rate in North Carolina is 4750.

The North Carolina state sales tax rate is currently. County Rates with Effective Dates as of April 1 2015. Historical County Sales and Use Tax Rates Effective Dates of Local Sales and Use Tax Rates in North Carolina Counties as of April 1 2019 Effective Dates of Local Sales and Use Tax Rates in North Carolina Counties as of April 1 2019.

Data Files Statistics Reports Download property data and tax bill files. Average Sales Tax With Local. North Carolina Sales Tax.

Nearly all of these increases stemmed from ballot measures though local government officials in Wake County North Carolina of which Raleigh is the county seat authorized a rate increase in 2017 as did officials in Albuquerque New Mexico and the District of Columbia in 2018. Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Manufactured and Modular Homes. County rate 60 Fire District rate 1027 Combined Rate 7027 No vehicle fee is charged if the property is not in a municipality Property value divided by 100.

North Carolina has a 475 sales tax and Wake County collects an additional 2 so the minimum sales tax rate in Wake County is 675 not including any city or special district taxes. County Rates with Effective Dates as of July 1 2020. This tax is collected by the merchant in addition to NC State Sales Tax and.

This is the total of state and county sales tax rates. North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275. Use the Wake County Tax Portal to view property details research comparable sales and to file a real estate appeal online.

Historical County Sales and Use Tax Rates. 85 x 7027 5973 estimated annual tax. This table shows the total sales tax rates for all cities and towns in Wake.

The 2018 United States. 3 rows Sales Tax Breakdown. Walk-ins and appointment information.

Aircraft and Qualified Jet Engines. 35 rows 700. Appointments are recommended and walk-ins are first come first serve.

Sales and Use Tax Rates Effective April 1 2019 NCDOR. ICalculator US Excellent Free Online Calculators for Personal and Business use.

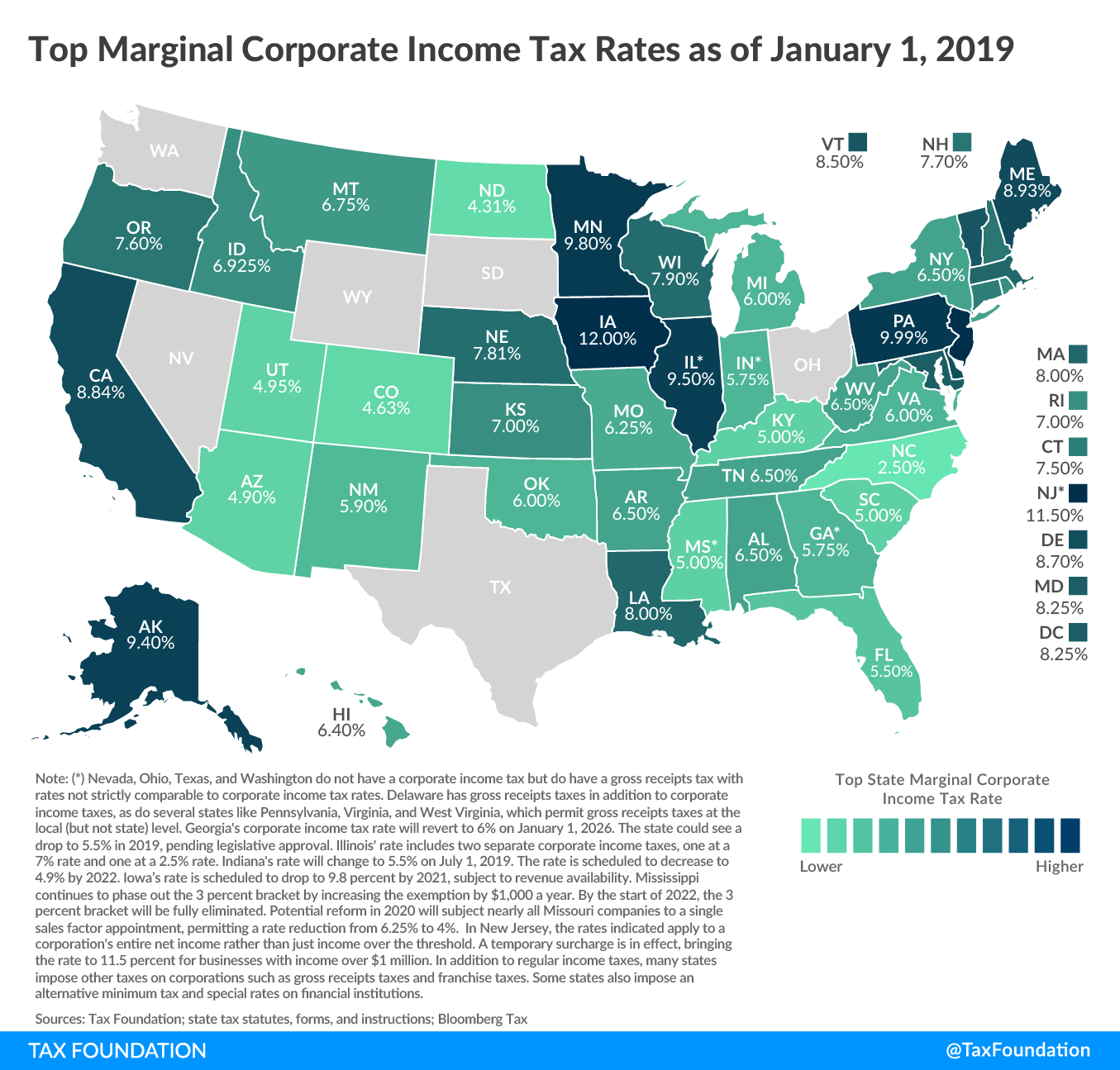

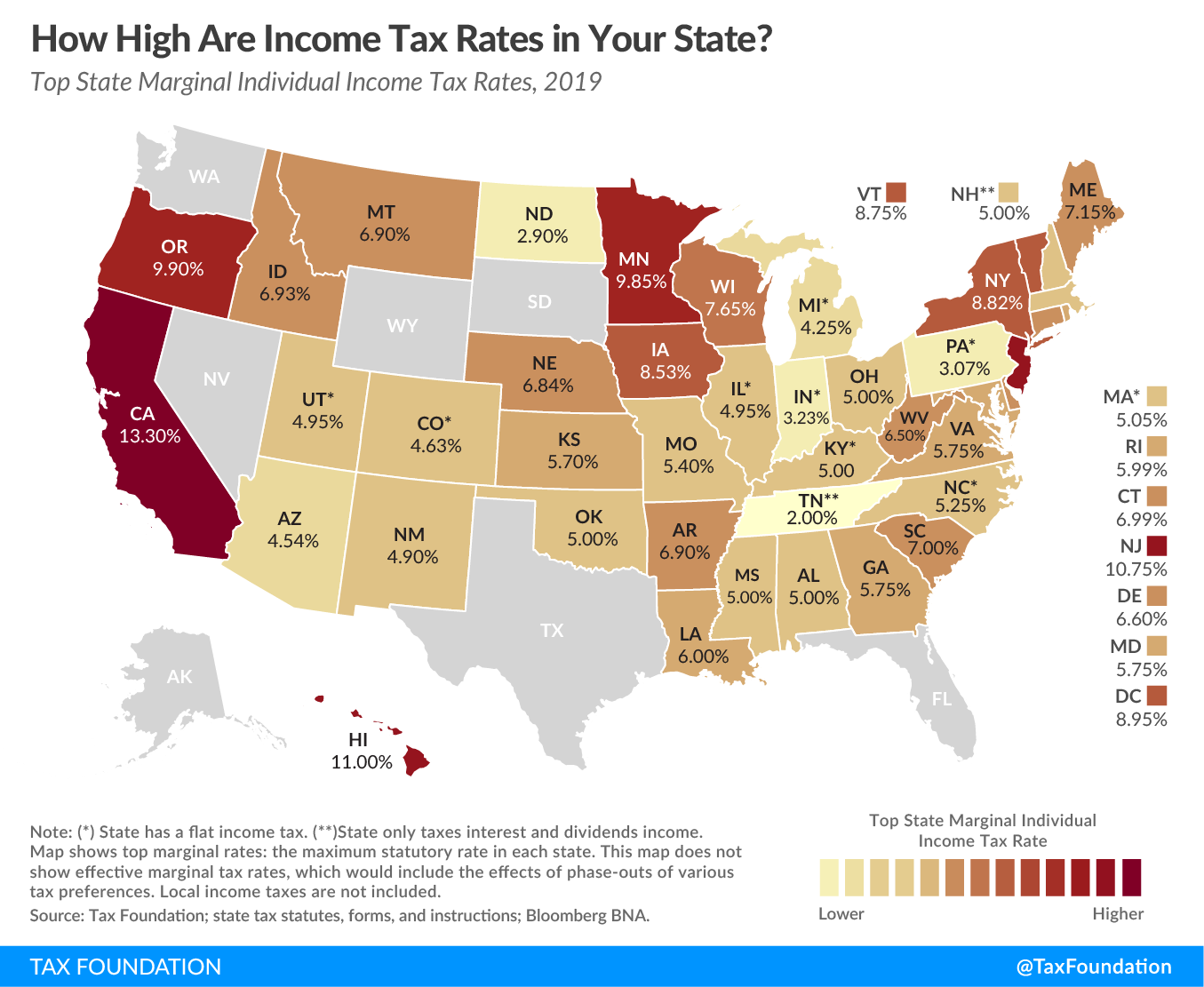

Taxes Cary Economic Development

Taxes Wake County Economic Development

Taxes Cary Economic Development

Sales Taxes In The United States Wikiwand

North Carolina Sales Tax Rates By City County 2022

Sales Tax On Grocery Items Taxjar

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

File Sales Tax By County Webp Wikimedia Commons

Wake County North Carolina Property Tax Rates 2020 Tax Year

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

How Proposal To Redistribute Sales Tax Revenue Would Affect Triangle Counties Raleigh Chapel Transfer Raleigh Durham Chapel Hill Cary North Carolina Nc The Triangle Area City Data Forum

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Taxes Cary Economic Development

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Sales Taxes In The United States Wikiwand

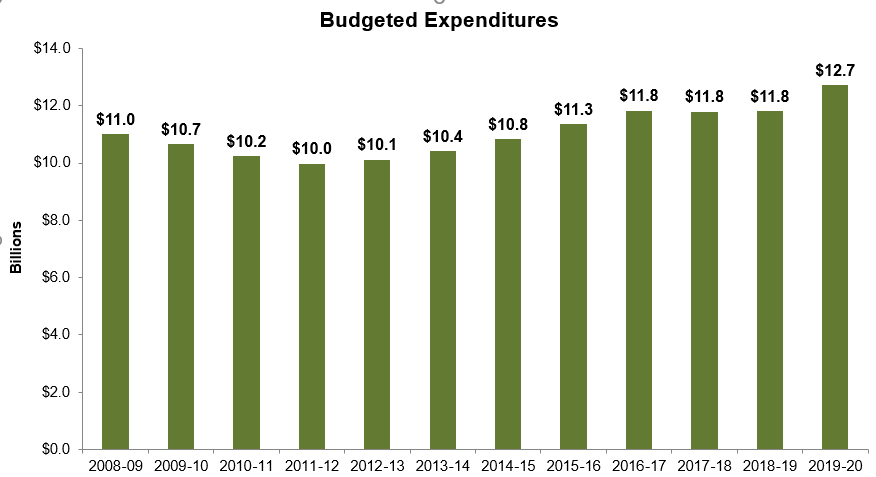

County Budget And Tax Survey North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners